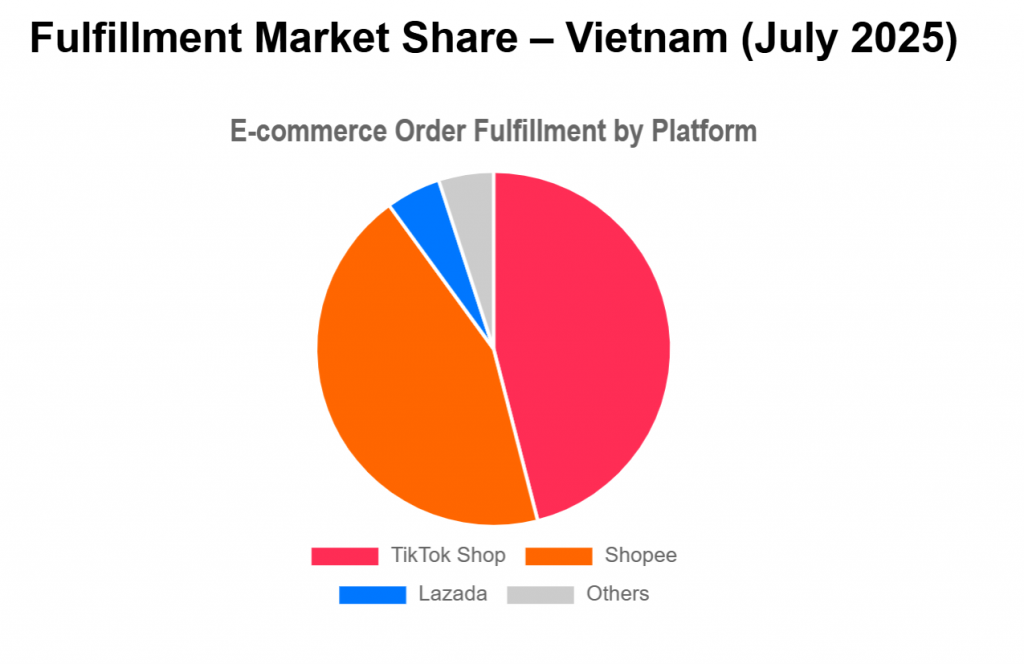

Ho Chi Minh City, July 30, 2025 — In a major shake-up of Vietnam’s e-commerce market, TikTok Shop has surpassed Shopee in total monthly fulfilled orders for the first time, according to data collected from top third-party fulfillment centers including Boxme, SwiftHub, N&H, and ODN.

TikTok’s rise is largely driven by its content-driven shopping model, with viral product videos converting directly into orders. Combined with seller-friendly policies and lightweight fee structures, the platform has become the go-to choice for small and medium-sized online sellers looking for faster conversions and lower operating costs.

Meanwhile, Shopee, long the market leader, is facing mounting criticism from its merchant community over rising fees, a strict return policy, and increasing operational pressure. Many sellers have begun shifting inventory and marketing budgets toward TikTok Shop, citing better profit margins and reduced platform friction.

“TikTok’s model is allowing sellers to reach buyers instantly while keeping fulfillment costs low. It’s a different kind of engine,” said a manager at Boxme.

Alongside this major shift, Lazada is quietly re-entering the competition, capturing an estimated 5% of total fulfilled orders in July. While still trailing significantly behind TikTok and Shopee, Lazada’s reactivation signals a renewed effort to regain relevance, especially through strategic campaigns and partnerships with local fulfillment partners.

Despite Shopee’s long-term dominance, July’s numbers show a realignment of market momentum. TikTok is working closely with decentralized fulfillment providers, tapping into existing networks to scale quickly — without the need for vertically owned logistics infrastructure.

SwiftHub, one of the country’s fastest-growing fulfillment networks, first observed a steady rise in TikTok Shop order volumes beginning in April 2025. Over the past four months, the platform’s growth has accelerated, driven by viral product discovery through video content and a surge in seller onboarding.

“We saw the tipping point coming,” said a SwiftHub spokesperson. “TikTok’s order volumes grew rapidly through Q2, and by July, they had clearly overtaken Shopee across our network.”

With major campaigns like 9.9 and 11.11 approaching, the industry is watching closely to see whether Shopee can mount a comeback, whether TikTok will continue pulling ahead, and if Lazada’s re-entry will meaningfully shift the balance.